Refine, maximize, protect, and monetize enterprise value through innovative financial strategies.

Empower yourself – a business owner or company leader through our forward-thinking solutions with a deep understanding of human capital and financial management. We align the expertise, resources, and connections within our thoughtfully integrated ecosystem to deliver measurable progress toward pre-determined goals and priorities.

Our Expert Solutions:

Executive and Key Employee Benefits

The strength of a company lies in its bench of committed mission-critical people, especially its leadership. According to the 2024 NFP US Executive Compensation and Benefits Trend Report, 86% of business leaders believe executive benefits are critical to their company’s success because they can’t afford to lose top talent while 71% recognize that retention will play a significant role in driving future success.

We design and implement innovative benefit programs that not only attract and reward exceptional talent but also foster loyalty by aligning their goals with the company’s vision. Our strategies empower top performers to think like owners, creating a culture of shared success and driving sustainable growth.

ERISA Plan Fiduciary Services

As an ERISA 3(21) and 3(38) fiduciary, we provide expert oversight and management of retirement plans – reducing the administrative burden and liability for plan sponsors. Our fiduciary services include:

- ERISA 3(21) Services: Acting as a co-fiduciary to guide plan sponsors in decision-making, ensuring compliance, and sharing fiduciary responsibility.

- ERISA 3(38) Services: Taking full discretionary authority over plan investment decisions, allowing businesses to focus on their core operations while ensuring fiduciary obligations are met.

By adhering to the highest fiduciary standards, we help plan sponsors safeguard participant interests, minimize risk exposure, and deliver optimized retirement outcomes.

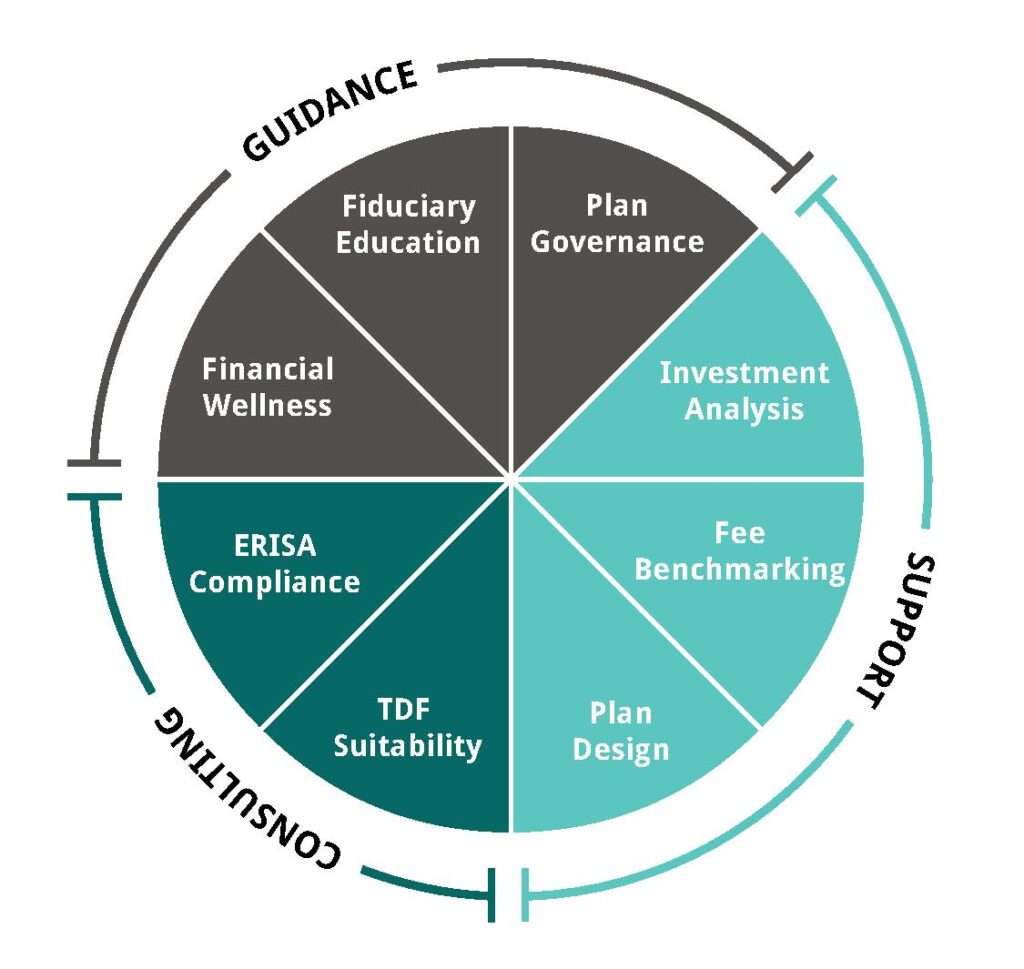

Comprehensive Retirement Plan Services

Our service model is built to provide plan sponsors with a complete solution for retirement plan management. By encompassing all essential components — such as fiduciary education, plan governance, investment analysis, fee benchmarking, and ERISA compliance — we ensure a seamless approach to plan oversight. This integrated model helps safeguard participant interests, maintain regulatory compliance, and deliver cost-effective, well-designed plans.

With a focus on guiding, supporting, and consulting, we address every aspect of plan administration while minimizing liability for plan sponsors. Our commitment to financial wellness and strategic plan design empowers participants to achieve better retirement outcomes, allowing businesses to focus on their core operations with confidence in their fiduciary responsibilities.

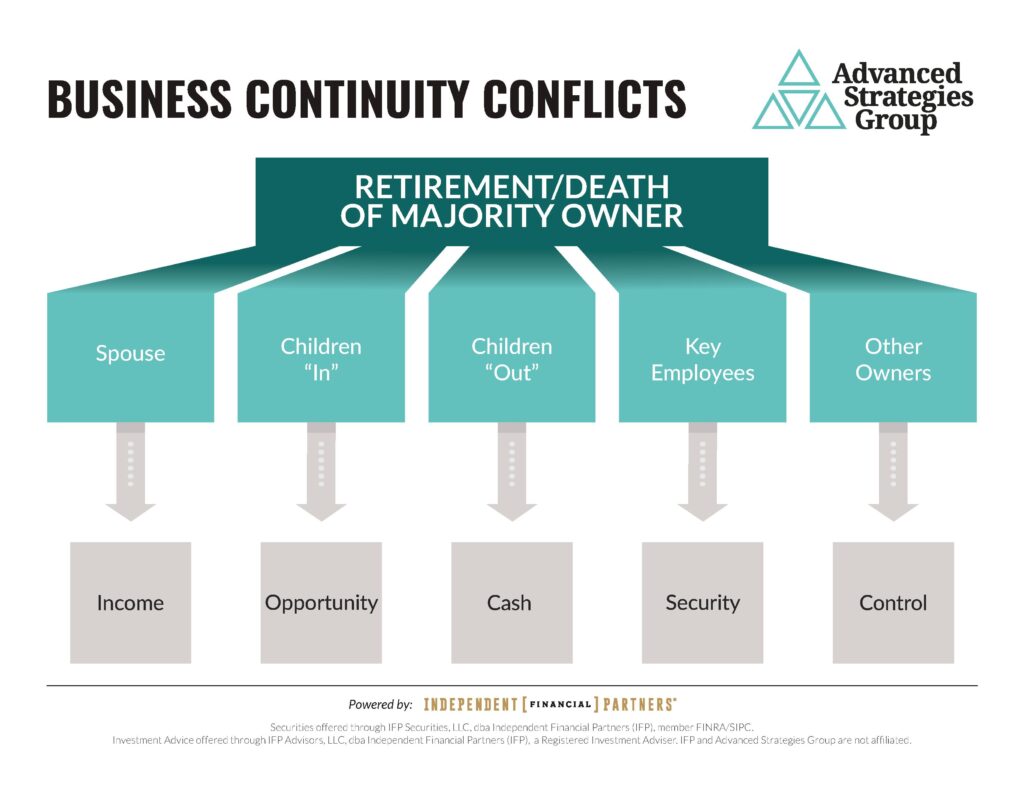

Designing Exit and Succession Plans

Planning for the future is critical for every business owner. We specialize in designing strategies that facilitate seamless exit planning and internal business succession.

- Internal Business Succession Planning: Helping owners transition leadership to the next generation of leaders, ensuring business continuity and preserving the company’s legacy.

- Buy-Sell Agreements: Creating well-structured agreements among co-owners to protect the business from unexpected events and clarify the terms of ownership transfer.

- Exit Planning Strategies: Designing comprehensive plans to maximize enterprise value, minimize taxes, and align with both the owner’s financial and personal goals as well as other key stakeholders.

These strategies ensure a smooth transition while safeguarding the business’s longevity, value, success, and legacy.

Cash Reserve and Investment Portfolio Management

A robust financial foundation is vital for navigating opportunities and challenges. We provide expert guidance to build and maintain a “fortress balance sheet” that aligns with corporate goals while addressing:

- GAAP compliance and complex accounting standards.

- Liquidity needs for operational agility and emergencies.

- Corporate covenants and creditor protection to safeguard assets.

- Strategic deployment of resources for maximum impact.

With the right strategies in place, businesses can manage risk, seize opportunities, and ensure financial resilience.

Why These Focus Areas Matter

In a competitive landscape, retaining and incentivizing top-tier talent is no longer optional—it’s critical to success. By combining strategies that prioritize human capital with expert financial management, fiduciary oversight, and exit planning, we help business owners unlock the full potential of their enterprise and navigate the complexities of modern business with confidence.